The UAE is a hub for international trade, making it an attractive destination for businesses looking to expand their reach. However, navigating the complex regulations of UAE Customs can be a challenge for many companies without the help of logistics companies. They offer expert services that help businesses navigate customs regulations and ensure smooth, hassle-free import and export processes. Logistics companies arrange the transportation of goods, coordinate shipping, and handle customs for businesses. They provide several other services, including document preparation, consolidation and deconsolidation of shipments, warehousing and storage, international communication, insurance coverage, tracking and monitoring shipping, and negotiating with carriers for the best rates while being careful of special cargo requirements.

Understanding the fine points of UAE customs logistics isn’t just about complying with the letter of the law; it’s about utilizing that understanding to operate your logistics efficiently. The UAE’s customs and regulatory environment are designed to facilitate trade that ensures not only the security of imported and exported goods but also smooth compliance with specific import and export regulations. From the commencement of customs clearance through each targeted import/export regulation to the most granular customs process or trade transaction, the UAE’s customs regulations and processes require consistent attention to detail.

For logistics professionals, compliance is not an option but mandatory. The landscape is complex, but those with a mastery of it have opportunities. With an appreciation of the role of the UAE customs authority, the customs clearance process, duties and taxes, and the broader regulatory environment, stakeholders can fine-tune operations, trim delays, and limit penalties. As we journey through regulations and compliance in UAE logistics, it’s important to remember that the landscape is forever changing. Knowledge of regulatory modification and the agility to respond are essential for success in the UAE’s fast-moving logistics sector. Come with us as we dissect the customs and regulations in UAE logistics, building the foundations for seamless logistics operations in what is arguably the world’s most dynamic trade ecosystem.

Understanding UAE Customs Logistics

The Role of UAE Customs

Customs authorities in the UAE play a central role in the country’s trade and logistics ecosystem, supporting legitimate trade, the collection of customs duties, and the prevention of the entry and exit of prohibited goods while ensuring that goods being moved across UAE borders are compliant with local and international laws for the overall safety and economic security of the country. Customs authorities in the UAE are also key to driving policies that align with the UAE’s vision of becoming a global trade and logistics hub and seek to introduce the right services to expedite the customs clearance process while ensuring compliance with the regulatory requirements.

Customs Clearance Process in the UAE

The customs clearance process in the UAE is streamlined to support efficient trade facilitation, yet it requires thorough preparation and understanding from businesses. The process typically involves:

- Documentation Preparation: The importer must obtain and prepare the required documents before the under-mentioned goods arrive in the UAE. The documentation includes a detailed invoice, packing list, original bill of lading/air waybill, and any other documents such as the Certificate of Origin and the invoice legalized by the sorting center. The original bill of lading/air waybill should be marked to the order of the bank mentioned in the LC or to the consignee or his agent. A non-negotiable copy of the bill of lading/air waybill should be sent directly to the consignee or his agent as soon as the ship or aircraft sails from the place of export.

- Declaration Submission: Importers are required to submit a customs declaration through the UAE’s electronic customs systems, describing the nature, quantity, and value of the goods and any other relevant information.

- Duty Payment and Inspection: Based on the Customs Declaration, customs duties are calculated. For certain shipments, they may be physically inspected or screened using a variety of non-intrusive inspection techniques. Duty payment is necessary for the cargo release to take place. Note that applicable inspection fees are to be paid by the importers.

- Goods Release: Once the duties are paid and any necessary inspections are passed, the goods are released from customs. It is then time for the importers to make arrangements for transportation to the final destination.

Duties and Taxes

Customs duties in the UAE are normally calculated as a fixed percentage, which is usually 5% of the CIF (cost, insurance, and freight) value of the imported goods. A few items, such as tobacco and alcohol, are set at higher rates. In addition, VAT is now being charged in the UAE and is collected by customs at a standard rate of 5%, so most imported goods are also subject to VAT. However, businesses that are registered for VAT can often reclaim the VAT paid on imports (subject to the usual VAT regulations in the UAE being met).

Businesses involved in international trade need to have a good understanding of customs logistics in the UAE. By complying with customs requirements and utilizing the facilities and services extended by UAE customs authorities, businesses can ensure the smooth and quick import and export of goods.

Import/Export Regulations in the UAE

General Regulations

To decode the import/export landscape in the UAE, one requires an in-depth understanding of the country’s regulatory framework. A key facilitator is documentation. Firms should record all the necessary documents, such as the detailed invoice, certificate of origin, bill of lading, packing list, and, in certain goods categories, additional permits and certificates. The UAE has created a list of prohibited and restricted items that include narcotics, ivory, and counterfeit currency, among others, aimed at protecting its society and economy.

Sector-Specific Regulations

The diverse economy of the UAE means that sector-specific regulations are in place to address the unique needs of various industries.

- Food and Beverage: Importers must comply with strict safety and health standards. Companies need to secure relevant health certificates and ensure labeling meets local requirements.

- Pharmaceuticals: This sector is heavily regulated, with a focus on ensuring the safety and efficacy of drugs. Importers must obtain approval from the Ministry of Health & Prevention and ensure products are correctly labeled and stored.

Adherence to these regulations is critical for legal compliance and the integrity and reputation of businesses operating in these sectors.

Technology and Innovation in Compliance

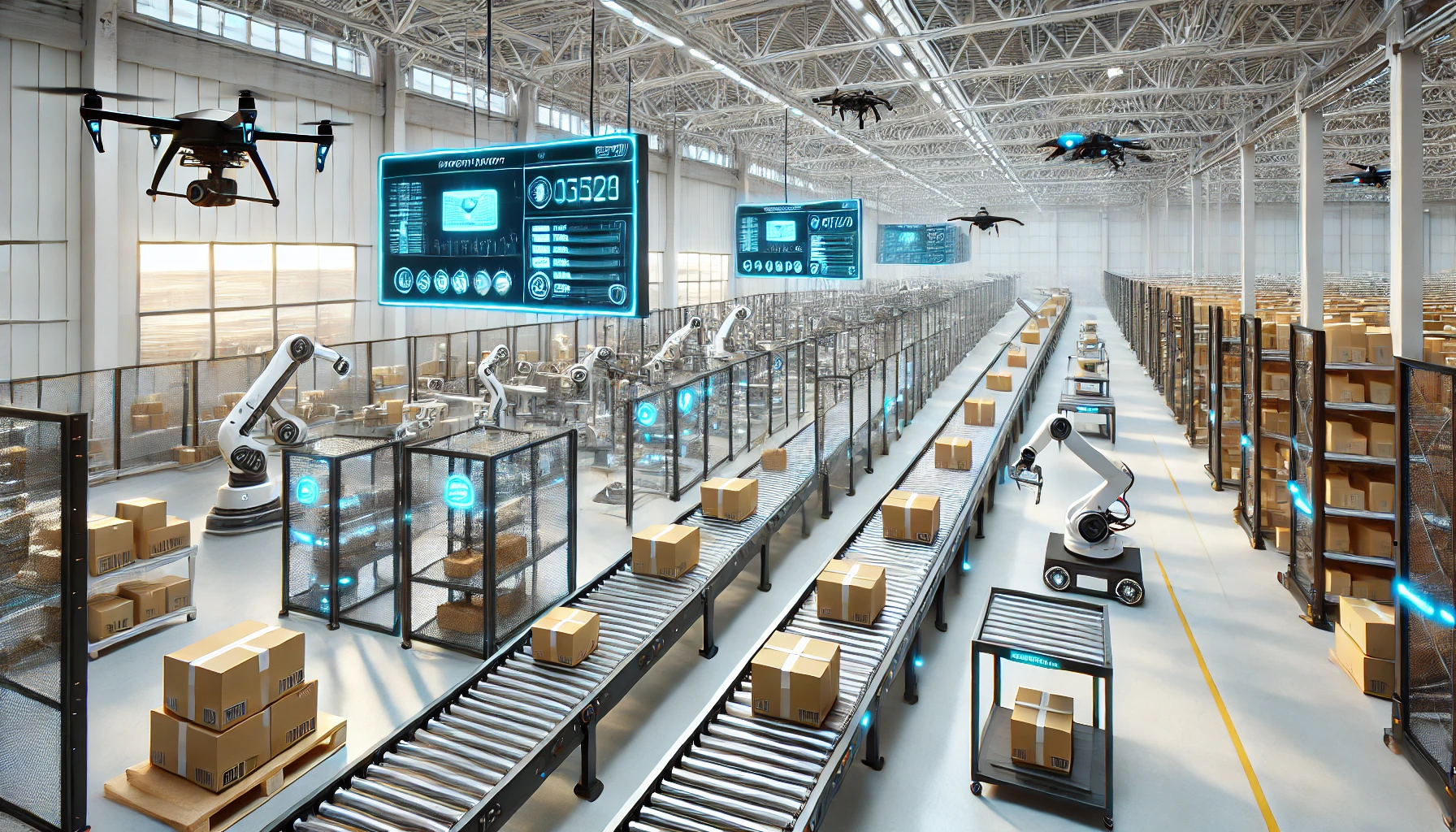

When it comes to utilizing technology to speed up trade and customs procedures, it has always been on the UAE frontlines. Artificial intelligence (AI) and blockchain are used in customs operations to improve efficiency, decrease paperwork, and increase transparency. One example is the “Logistics Passport” program from Dubai Customs, which provides a centralized digital system that streamlines import and export procedures for companies. In addition to making compliance easier, these technological developments are paving the way for future developments in the logistics industry, where digital transformation will continue to be important.

Understanding these restrictions and utilizing technology for compliance is important for businesses trying to navigate the complexity of import and export in the UAE effectively. Keeping up with legal changes and technological advancements might help you gain a competitive advantage in the fast-paced UAE industry.

Compliance in UAE Logistics

Regulatory Bodies and Compliance Requirements

Several significant regulatory organizations supervise the landscape of UAE logistics compliance, with each playing an important role in creating and enforcing the regulations that regulate commerce and logistics. The Federal Customs Authority (FCA) sets national customs policies, which are then implemented by local customs departments in Dubai, Abu Dhabi, and other emirates. The Ministry of Economy and the Dubai Trade Agency play an important role in regulating trade practices and supporting international trade.

Compliance requirements in the UAE logistics industry include a wide range of rules, from customs declarations and duty payments to complying with prescribed criteria for product safety, labeling, and environmental sustainability. Logistics operators must verify that all shipments follow UAE customs legislation, get any relevant permissions and licenses for specific categories of commodities, and comply with international trade agreements to which the UAE is a member.

Best Practices for Ensuring Compliance

Compliance in UAE logistics requires strategic planning, awareness of the regulatory environment, and the use of technology. Key recommended practices include:

- Regular Training and Updates: Keeping employees up to date on the newest legislation and compliance processes is important. Regular training sessions could help ensure that team members are updated on the latest compliance requirements.

- Leveraging Technology: Customs management software and other technology technologies can help streamline the compliance process, decrease documentation mistakes, and speed up clearance times.

- Building Strong Relationships with Regulators: Engaging with regulatory bodies and customs authorities can provide insights into compliance best practices and early warnings about regulatory changes.

- Compliance Audits: Conducting regular internal audits of logistics operations can help identify potential compliance issues before they become problematic.

Case Studies on Compliance

- Total Freight International (TFI) is a notable example in the UAE logistics sector that demonstrates how businesses navigate compliance and regulatory challenges. Established in 1991, TFI has grown from an international freight forwarder into a comprehensive logistics solutions provider, boasting state-of-the-art 3PL warehouse facilities in Dubai Logistics City. Their services range widely, from international cargo transportation and warehousing to distribution, all backed by a digital-driven infrastructure and a global agent network. TFI’s commitment to compliance is evident through its ISO 9001:2015 and ISO 45001: 2018 certifications, showcasing their adherence to international standards in quality management and occupational health and safety.

- On the regulatory front, significant changes have occurred in the UAE’s approach to foreign ownership and company compliance. A notable amendment to the Commercial Companies Law (CCL) in 2020, Decree Law No. 26, removed the mandatory requirement for 51% UAE national ownership for onshore companies, allowing for 100% foreign ownership in over 1,000 commercial and industrial activities. This development is crucial for logistics and other sectors, enabling greater foreign investment and simplification of business operations in the UAE. Additionally, the decree introduced new governance and compliance regulations for Limited Liability Companies (LLCs), requiring adjustments to corporate documents and general meeting procedures by the end of 2021. These regulatory updates signify a substantial shift towards more liberal business practices in the UAE, aiming to attract foreign investment and enhance the country’s competitiveness as a logistics hub.

These case studies emphasize the significance of a proactive approach to compliance, illustrating how knowing and following rules may dramatically improve operational efficiency while lowering the risk of noncompliance.

Challenges and Solutions in UAE Logistics Compliance

The dynamic and complicated nature of UAE logistics compliance poses several obstacles for enterprises working in the field. Navigating these obstacles properly is necessary to ensure smooth operations and avoid legal consequences. Let’s discuss frequent problems and effective solutions for improving compliance efforts.

Common Compliance Challenges

- Regulatory Changes: The UAE’s regulatory environment is constantly changing, making it difficult for firms to remain up to speed on the newest customs and trade rules.

- Complex Documentation Requirements: The considerable documentation necessary for customs clearance can be overwhelming, especially for newcomers to the market.

- Sector-Specific Regulations: Businesses in highly regulated industries, such as food and pharmaceuticals, have additional levels of compliance obligations.

- Technological Integration: While technology provides answers for improving compliance procedures, integrating new systems and training employees on these platforms may be difficult.

Practical Solutions and Tips

- Stay Informed: Businesses should actively follow developments from UAE regulatory organizations and consider signing up for updates from reliable legal and trade consultancy firms.

- Invest in Compliance Software: Using customs and compliance management software may automate many areas of the paperwork process, lowering the likelihood of mistakes and noncompliance.

- Participate in Industry Groups: Joining trade and industry associations may give useful insights into sector-specific compliance concerns and solutions.

- Seek Expert Advice: Working with legal and customs specialists may help organizations traverse complicated regulatory environments and build successful compliance plans.

- Training and Development: Regular training programs for employees on regulatory compliance, documentation practices, and technology use are critical for keeping a knowledgeable and capable team.

- Collaboration with Customs Officials: Establishing a strong connection with customs authorities may help to streamline operations and offer access to support and guidance on compliance issues.

Conclusion

Navigating the complicated environment of UAE logistics and customs rules necessitates a thorough and knowledgeable strategy to guarantee compliance and operational efficiency. The UAE’s trade rules are dynamic, and global trade practices are always evolving, so firms must remain up to date on regulatory changes and use technology to expedite procedures. Businesses may reduce risks and enhance their logistical operations by knowing the function of UAE customs, the customs clearance procedure, and the import/export rules that apply. Investing in compliance software, connecting with industry associations, and obtaining professional assistance are all realistic measures toward attaining compliance and increasing competitiveness in the UAE’s thriving trade environment.

Furthermore, developing good ties with regulatory agencies and customs personnel can give vital insights and assistance. As the UAE positions itself as a prominent global logistics center, the ability to effectively manage its regulatory environment will remain a vital success factor for enterprises operating in and through the UAE. Accepting these obstacles as opportunities for innovation and development may promote not just compliance but also operational excellence in today’s changing trading environment.

Ready to streamline your logistics operations in the GCC, South Asia, and Central Asia? Wahyd Logistics is your gateway to hassle-free, efficient, and comprehensive logistics solutions.